The graph shows that mixed costs are typically both fixed and linear in nature. In other words, they will often have an initial cost, in Ocean Breeze’s case, the $2,000 fixed component of the occupancy tax, and a variable component, the $5 per night occupancy tax. Note that the Ocean Breeze mixed cost graph starts at an initial $2,000 for the fixed component and then increases by $5 for each night their rooms are occupied. Two specialized types of fixed costs are committed fixed costs and discretionary fixed costs.

Products

A proper management and control over costs is crucial to maintain and grow profits which is the primary objective of every commercial business. The first step in achieving this is to understand the nature of costs that a business incurs while carrying out its operations as well as the factors affecting those costs. It is not unheard of for a business to decide against taking steps to increase volume in order to maintain profitability at current levels. Let us discuss the importance of understanding the points on a step cost graph through the explanation below. When they produce 625 boats, Carolina Yachts has an AFC of $2,496 per boat.

2: Cost Behavior Vs. Cost Estimation

Ocean Breeze pays $2,000 per month, regardless of the number of rooms rented. Even if it does not rent a single room during the month, Ocean Breeze still must remit this tax to the county. However, for every night that a room is rented, Ocean Breeze must remit an additional tax amount of $5.00 per room per night.

Mixed Costs and Stepped Costs

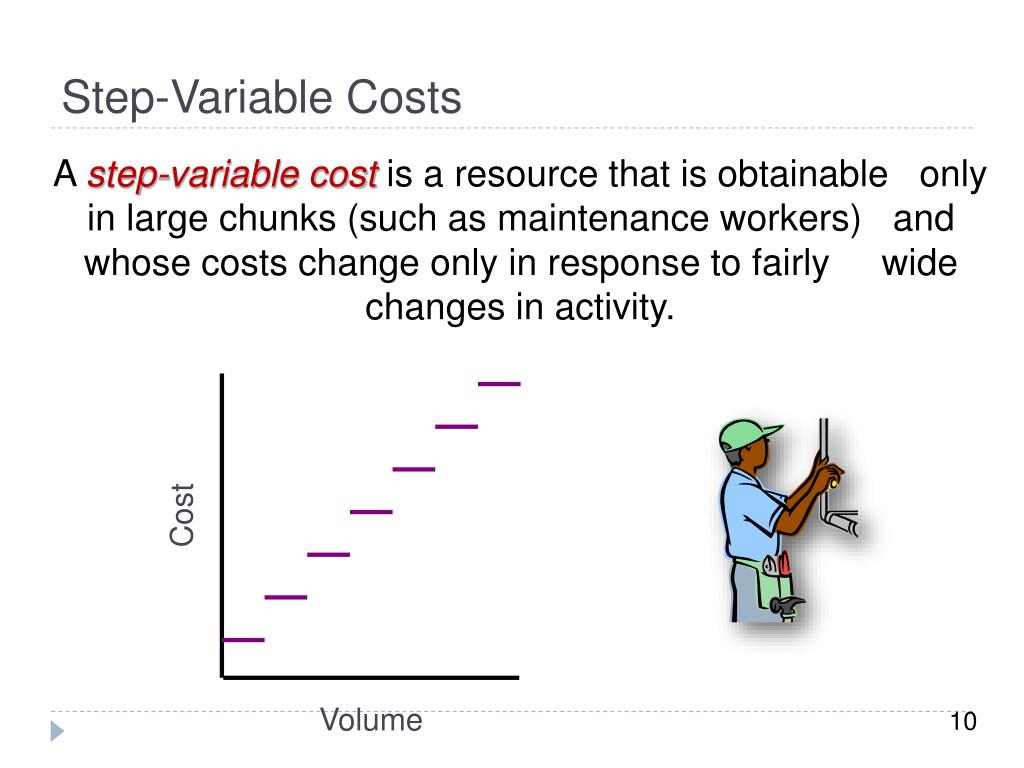

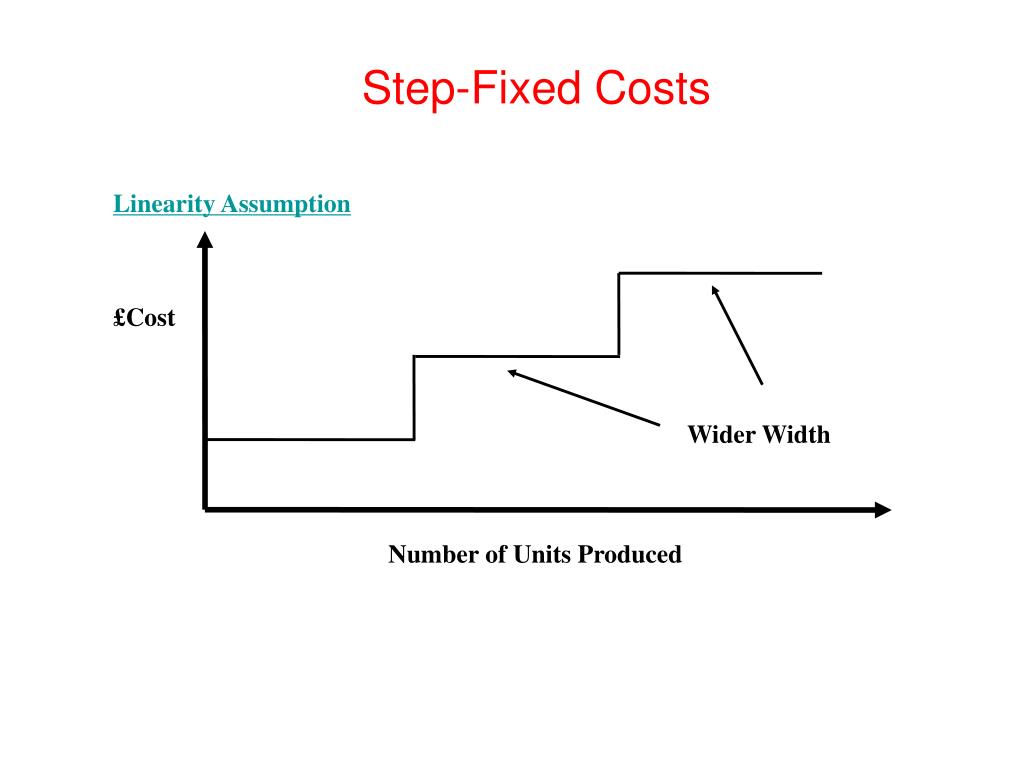

On the contrary, the cost changes disproportionately in the case of step cost. This is because it follows a step pattern, which means it remains constant up to a certain activity level (e.g., production level). Similarly, if the activity level is reduced to a previous level, the cost decreases.

As a result, it may be necessary to analyze some fixed costs together with some variable costs. Ultimately, businesses strategically group costs in order to make them more useful for decision-making and planning. Two of the broadest and most common grouping of costs are product costs and period costs. Because a step variable cost can remain approximately the same while activity levels change, this step effect can impact the allocated cost per manufactured unit. We have spent considerable time identifying and describing the various ways that businesses categorize costs.

- Ocean Breeze pays $2,000 per month, regardless of the number of rooms rented.

- Understanding step costs is crucial for analyzing cost behavior patterns and creating flexible budgets, as they can significantly impact financial planning and decision-making.

- The article “true variable vs step variable cost” looks at meaning of and differences between these two types of variable costs – true variable cost and step variable cost.

- Discretionary fixed costs generally are fixed costs that can be incurred during some periods and postponed during other periods but which cannot normally be eliminated permanently.

- These costs remain constant at a certain operational level, and beyond which these costs start to change (i.e., increase or decrease).

The step cost incurred would be the salaries as the company would pay additional salaries for shift supervisors to oversee the additional shift. An example of a step variable cost is the compensation of a quality assurance (QA) worker in the assembly area of a production department. Each QA worker is capable of reviewing a certain number of parts turbotax review for 2021 per day. Once the production process exceeds that volume level, another quality assurance worker must be hired. These costs also provide valuable insights into cost-volume-profit relationships. Understanding how costs behave as activity levels change helps managers assess the financial feasibility of different production levels and product lines.

Ignoring step costs can lead to inaccurate budgeting and decision-making, potentially affecting a company’s financial performance and competitiveness. Recognizing and understanding step costs is essential for effective cost management and strategic business planning. In other words, you will stay in business if you don’t incur the cost. If the pencil maker spends $5,000 on advertising the pencils, this is a fixed cost. However, it is avoidable because the pencil maker can stop buying advertising and still stay in business (although sales volume may suffer). These cost classifications are common in businesses that produce large quantities of an item that is then packaged into smaller, sellable quantities such as soft drinks or cereal.

Let us now discuss the formula to plot a step cost graph that shall act as a basis for our understanding of the concept and its related factors through the discussion below. For example, the depreciation on an ethanol facility is the same regardless of whether the facility is operated at 75% of capacity or 100% of capacity. While in the example Carolina Yachts is dependent upon direct labor, the production process for companies in many industries is moving from human labor to a more automated production process. For these companies, direct labor in these industries is becoming less significant. For an example, you can research the current production process for the automobile industry. As you’ve learned, direct materials are the raw materials and component parts that are directly economically traceable to a unit of production.

Let’s examine Tony’s screen-printing company to illustrate how costs can remain fixed in total but change on a per-unit basis. Ifthe total direct labor cost increases as the volume of outputincreases and decreases as volume decreases, direct labor is avariable cost. Piecework pay is an excellent example of directlabor as a variable cost. In addition, direct labor is frequently avariable cost for workers paid on an hourly basis, as the volume ofoutput increases, more workers are hired. However, sometimes thenature of the work or management policy does not allow direct laborto change as volume changes and direct labor can be a fixedcost.